On December 15, the Securities and Exchange Commission (SEC) proposed enhanced disclosure requirements and amendments to the rules regarding issuer share repurchases and Rule 10b5-1 plans. The proposals related to Rule 10b5-1 plans address perceived gaps in the current reporting obligations and concerns over insider trading, which SEC Chairman Gary Gensler first raised in early summer 2021. Likewise, the share repurchase proposals aim to “lessen the information asymmetries between issuers and investors.”

These topics have received political, media and academic commentary over the years but little SEC enforcement attention. The key takeaway is that these proposals would be very impactful and make substantive changes to how such activities are conducted today. The relatively short comment period (45 days from the date of Federal Register publication) means these proposals could become final rules in the first half of 2022.

Share Repurchases

The proposed rules regarding share repurchases, also known as buybacks, include, among other items, repurchase disclosure on a new “Form SR” and increased periodic disclosures by amending Item 703 of Regulation S-K.

- New Form SR

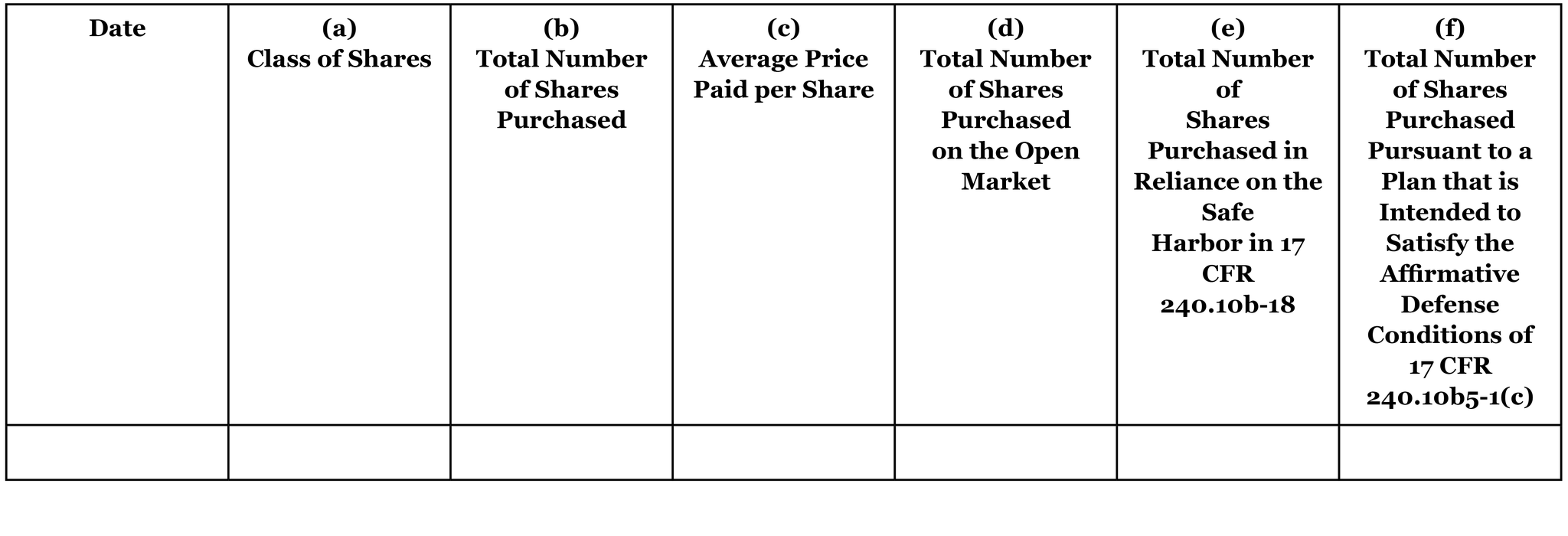

- Issuers would be required to furnish (but not file) Form SR before the end of the first business day after the day on which the issuer repurchases shares. (Note Section 16 reporting is within two business days and Form 8-K reporting is within four business days.) Form SR would require disclosure of the following:

- Date of the repurchase.

- Identification of the class of securities purchased.

- The total number of shares purchased, including all issuer repurchases whether or not made pursuant to publicly announced plans or programs.

- The average price paid per share.

- The aggregate total number of shares purchased on the open market.

- The aggregate total number of shares purchased in reliance on the safe harbor in Exchange Act Rule 10b-18.

- The aggregate total number of shares purchased pursuant to a plan intended to satisfy the affirmative defense conditions of Exchange Act Rule 10b5-1(c).

- Issuers would be required to furnish (but not file) Form SR before the end of the first business day after the day on which the issuer repurchases shares. (Note Section 16 reporting is within two business days and Form 8-K reporting is within four business days.) Form SR would require disclosure of the following:

The tabular disclosure required by Form SR follows:

- Enhanced Item 703 Disclosures

- Additionally, the proposal would require enhanced periodic disclosures about repurchases. Specifically, if amended, Item 703 of Regulation S-K would require disclosure accompanying the existing 703 table of the following:

- Objectives or rationales for share repurchases and process for determining the amount of repurchases.

- Any policies and procedures relating to purchases and sales of securities by an issuer’s officers and directors during a repurchase program, including any restrictions.

- Whether repurchases were made pursuant to a plan intended to satisfy the affirmative defense conditions of Rule 10b5-1.

- Whether repurchases were made in reliance on Rule 10b-18’s nonexclusive safe harbor.

- Additionally, the proposal would require enhanced periodic disclosures about repurchases. Specifically, if amended, Item 703 of Regulation S-K would require disclosure accompanying the existing 703 table of the following:

- The proposed rules also would require the issuer to check a box indicating whether any of its Section 16 officers or directors purchased or sold shares of the class of the issuer’s equity securities that is the subject of an issuer buyback plan within ten business days before or after the announcement of such plan.

Rule 10b5-1 and Insider Trading

- New Conditions for 10b5-1 Affirmative Defense

- The proposed rules add the following new conditions to the affirmative defense to insider trading available under Rule 10b5-1(c)(1):

- If a director or Section 16 officer adopts a 10b5-1 plan (including the adoption of a modified trading arrangement), the plan must include a minimum 120-day cooling-off period before any trading can commence under the plan.

- After an issuer adopts a 10b5-1 plan, the plan must include a minimum 30-day cooling-off period before any trading can commence under the plan.

- Directors and Section 16 officers must certify that they are not aware of material nonpublic information about the issuer or the security when adopting or modifying a plan and that they are adopting the contract, instruction, or plan in good faith and not as part of a plan or scheme to evade the prohibitions of this section.

- The affirmative defense does not apply to multiple overlapping Rule 10b5-1 plans for open market trades in the same class of securities.

- 10b5-1 plans to execute a single trade are limited to one plan per 12-month period.

- 10b5-1 plans must be entered into and operated in good faith.

- The proposed rules add the following new conditions to the affirmative defense to insider trading available under Rule 10b5-1(c)(1):

- Enhanced Disclosures Related to Insider Trading

- Like share repurchases, the proposed rules related to Rule 10b5-1 plans require more comprehensive disclosure about the companies’ policies related to insider trading and 10b5-1 plans. Specifically, the proposed rules would require the following:

- Add new Item 408(b) of Regulation S-K to require disclosure in an issuer’s annual report on Form 10-K and proxy of whether or not the issuer has adopted insider trading policies and procedures. If adopted, the issuer would need to disclose such insider trading policies, or if not, explain why such policies and procedures have not been adopted.

- Amend Item 402 of Regulation S-K to add new Item 402(x)(1), which would require disclosure regarding an issuer’s policies and practices on the timing of awards of stock options, SARs or similar instruments in relation to the disclosure of material nonpublic information by the issuer, including how the board determines when to grant options (for example, whether awards are granted on a predetermined schedule); whether the board or compensation committee takes material nonpublic information into account when determining the timing and terms of an award, and if so, how the board or compensation committee takes material nonpublic information into account when determining the timing and terms of an award; and whether the registrant has timed the disclosure of material nonpublic information for the purpose of affecting the value of executive compensation.

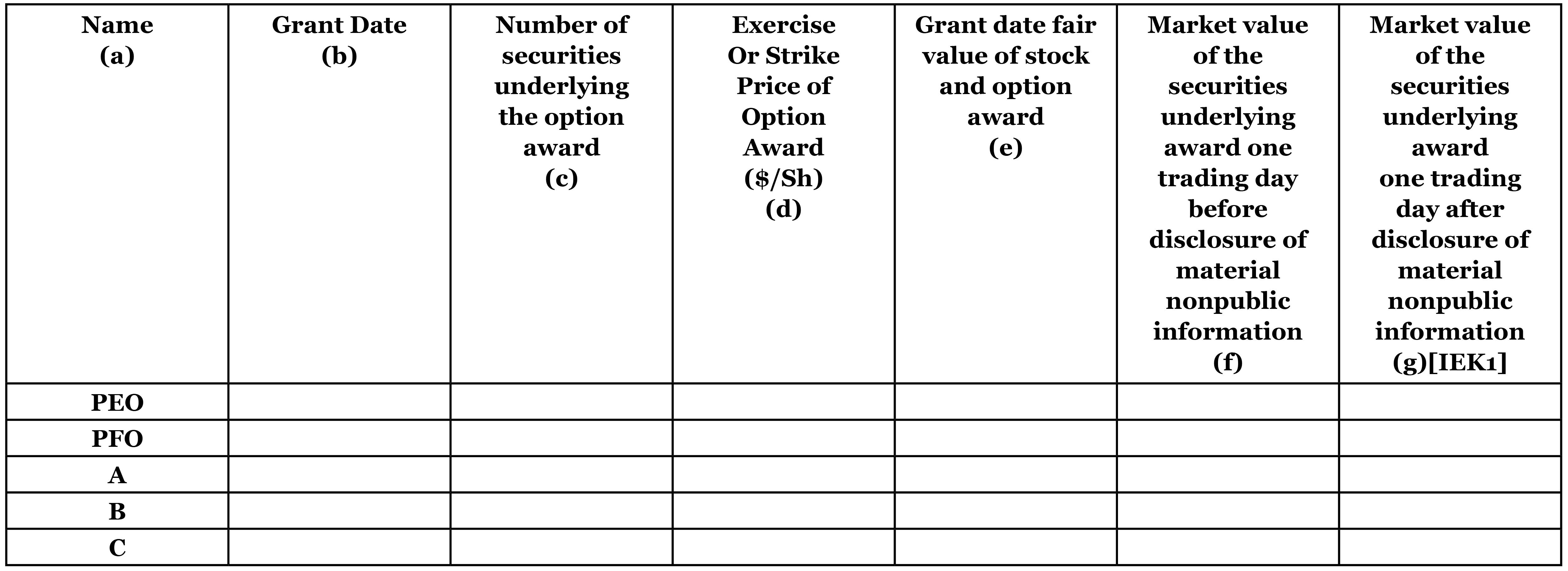

- Further amend Item 402 of Regulation S-K to add new item 402(x)(2), which would require tabular disclosure showing grants to named executive officers that were made within a 14-day period before or after the filing of a periodic report on Form 10-Q or Form 10-K, an issuer share repurchase, or the filing or furnishing of a current report Form 8-K that discloses material nonpublic information (including earnings information), which would include the market price of the underlying securities on the trading day before and after the release of the material nonpublic information.

- Like share repurchases, the proposed rules related to Rule 10b5-1 plans require more comprehensive disclosure about the companies’ policies related to insider trading and 10b5-1 plans. Specifically, the proposed rules would require the following:

An example of such tabular disclosure from new Item 402(x)(2) is provided below:

-

-

- Add new Item 408(a) of Regulation S-K to require disclosure in an issuer’s quarterly reports of the adoption, termination and material terms of Rule 10b5‑1 plans and other trading arrangements by directors, Section 16 officers, and the issuer (The material terms disclosure would include (i) the name and title of the director or officer; (ii) the date on which the director or officer adopted or terminated the contract, instruction or written plan; (iii) the duration of the contract, instruction or written plan; and (iv) the aggregate number of securities to be sold or purchased pursuant to the contract instruction or written plan).

- Disclosure by Section 16 officers and directors on Forms 4 and 5 by checking a box that the reported transaction was made pursuant to a Rule 10b5-1 plan.

- Disclosure by Section 16 officers and directors on Form 4 of any bona fide gifts of securities.

-

Key Takeaways for Public Companies

The proposed rules are quite far-reaching in their impact on current practices, in both share repurchase disclosure (essentially real-time repurchase disclosure on a new form) and director and officer trading (changes to 10b5-1 plans). Moreover, the enhanced disclosures around trading and the release of material nonpublic information will likely create additional hurdles to navigate as issuers and their directors and officers seek trading opportunities for their shares.

Companies should carefully consider these proposals and their impacts on their existing programs and protocols. We anticipate an active comment process during its shortened 45-day comment period, and we expect the SEC will be in a position to adopt final rules in the first half of 2022 after weighing the comments received.

If you have any questions regarding any of the topics covered in this blog post, please feel free to email the authors directly or, if applicable, contact your primary Bass, Berry & Sims relationship attorney.

About the Bass, Berry & Sims Corporate & Securities Practice

Public and private companies of all sizes across a variety of industries turn to Bass, Berry & Sims for counsel on a wide range of corporate matters, including mergers, acquisitions and dispositions; capital markets transactions; special purpose acquisition companies (SPACs) and de-SPAC transactions; executive compensation issues; corporate governance; ESG matters; and shareholder activism. We serve as primary corporate and securities counsel to numerous public companies and have counseled on more than 150 deals ranging in size from $20 million to more than $15 billion over the past two years. Click here to learn more about the Corporate & Securities Practice at Bass, Berry & Sims.